Sundaram Home Finance Limited: Best Home Loan in Swaminatha Nagar, Pudukottai

TS NO 3730/1 Shop no 1, First floor South 4th StreetPudukottai - 622001

Search For Your Dream Home Ends Here

- Home Loans for Salaried

- Home Loans for Self Employed

- Home Loans for NRI Salaried

- Home Extension Loans

- Home Improvement Loans

- Plot Loans

- Mortgage Loans

- Takeover Loans/Balance Transfer

- Top Up Loans

- Fixed Deposits

- Private salaried

- Government salaried

- Business

- Home Loans for Salaried

- Home Loans for Self Employed

- Home Loans for NRI Salaried

- Home Extension Loans

- Home Improvement Loans

- Plot Loans

- Mortgage Loans

- Takeover Loans/Balance Transfer

- Top Up Loans

- Fixed Deposits

- Private salaried

- Government salaried

- Business

About us

Looking for the best Home loan in Swaminatha Nagar, Pudukottai? Sundaram Home Finance Limited, located at TS NO 3730/1 Shop no 1, First floor South 4th Street, is a wholly owned subsidiary of Sundaram Finance Limited and was incorporated on 02nd July 1999. The Company offers Home Loans, Home Improvement Loans, Home Extension Loans, Plot Loans, Non-Residential Property loans, Mortgage loans on Residential and Commercial properties. We accept Fixed deposit rated AAA/Stable by ICRA & CRISIL. The Company is regulated by the RBI and supervised by the NHB. The Company has entered the 24th year of Operations with a network of over 125 branches across 11 States & 1 union territory. We have more than 2.50 lacs satisfied customers and a portfolio of around 12,000 crores.

7

Decades of HeritageSince 1999

In Housing Finance100+

Branches Across IndiaAAA

Credit ratingHome Financing and Other Services

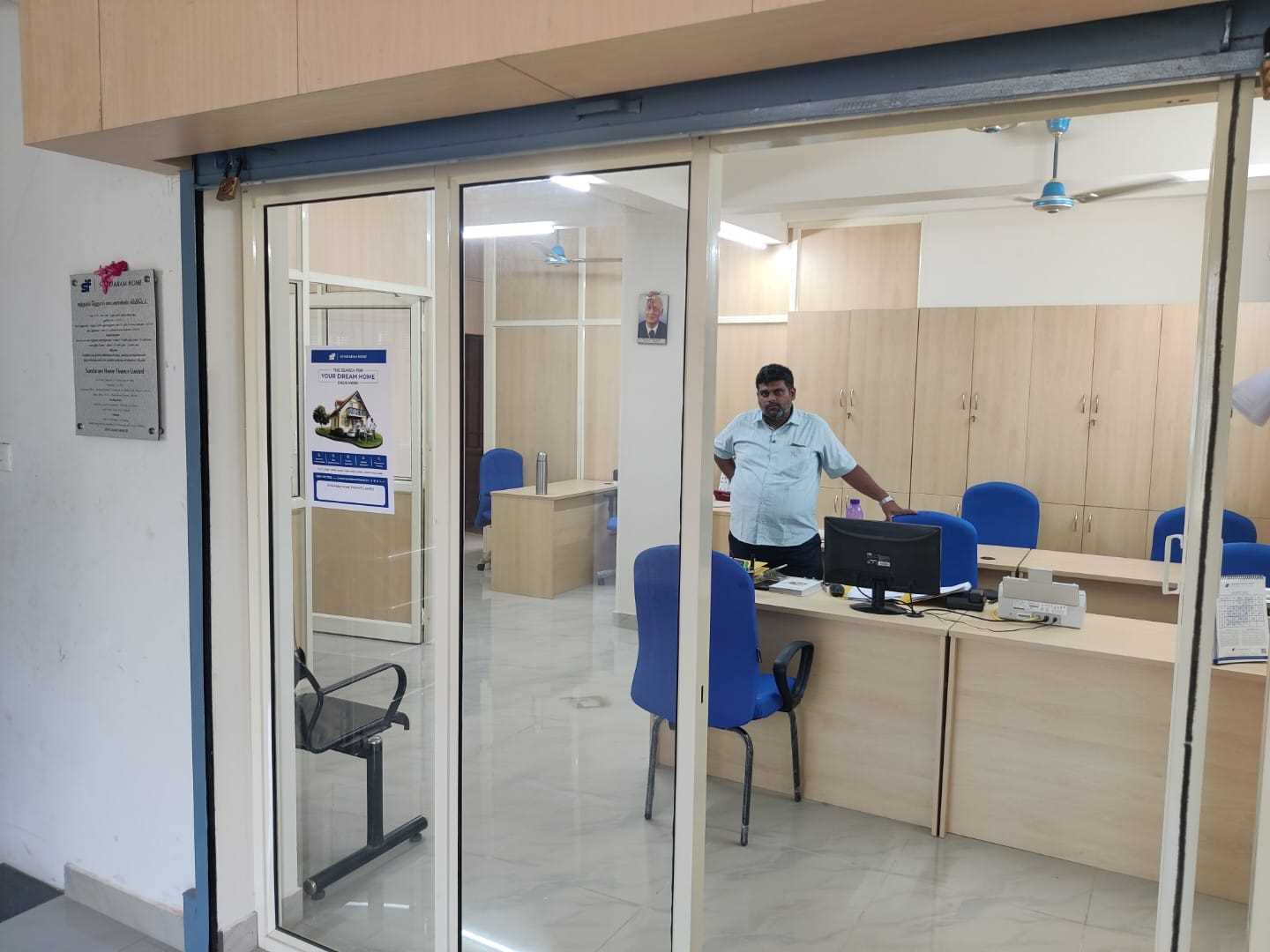

Branch Photo's of Sundaram Home in Swaminatha Nagar, Pudukottai

Ratings & Reviews of SHFL in Pudukottai at Swaminatha Nagar

-

Thilsathgroups

GOOD SERVICE BEST RATE OF INTEREST THANKS TO ENTIRE TEAM SPL THANKS TO Mr. SUDHAHARAN SIR FOR SERVICING

-

Mohammediliyas Mr

-

Mari Muthu

-

SANKAR R

-

Karthikeyan

Good

Get Direction to Sundaram Home in Pudukottai at Swaminatha Nagar

SHFL Branches Near Swaminatha Nagar at Pudukottai

Karaikudi - 630002

Trichy - 620001

Thanjavur - 613007

Kumbakonam - 612001

Dindigul - 624004

Madurai - 625010

Categories

- Fixed Deposits

- Home Extension Loan

- Home Improvement Loan

- Home Loan

- Mortgage Loan

- Plot Loan

- Takeover Loan/Balance Transfer

- Top Up Loan

Tags

home loan emi calculator Swaminatha Nagar

home loans rate of interest Swaminatha Nagar

home loans Swaminatha Nagar

home loan eligibility Swaminatha Nagar

plot loans Swaminatha Nagar

plot loan interest rate Swaminatha Nagar

land loans Swaminatha Nagar

mortgage loans Swaminatha Nagar

Loan Against Property Swaminatha Nagar

interest rates for mortgage loans Swaminatha Nagar

home extension loans Swaminatha Nagar

home improvement loans Swaminatha Nagar

home improvement loans interest rates Swaminatha Nagar

top up loans Swaminatha Nagar

top up home loan interest rate Swaminatha Nagar

take over loans Swaminatha Nagar

take over home loan Swaminatha Nagar

balance transfer home loan Swaminatha Nagar

balance transfer loan Swaminatha Nagar

Frequently asked Questions

Eligibility for tax benefits is present on the principal and interest components of the EMI paid on Home Loans (other than plot loans) under Section 80C & 24(b) of the Income Tax Act, 1961, that is in force as of date. These benefits are subject to change as per the policies of the Government.

Sundaram Home offers floating (variable) rate of interest which varies according to the market lending rates. Interest is calculated on monthly reducing balance basis, where the principal reduces every month from your EMI net of interest accrued.

Yes, definitely. Sundaram Home's wide network across southern India ensures hassle-free processing of loans under such conditions.

Co-applicant(s) can be co-owner(s) of the property in respect of which the financial assistance is sought. However all co applicant(s) need not be co-owners. Relatives as agreed by the company can join as co-applicant(s). Generally, co-applicants are husband, wife, father, son, mother, daughter, etc.

Factors such as age, monthly income, commitments, qualifications, repayment history and place of employment matter for eligibility.

Eligibility for tax benefits is present on the principal and interest components of the EMI paid on plot loans under Section 80C & 24(b) of the Income Tax Act, 1961, that is in force as of date. These benefits are subject to change as per the policies of the Government.

Yes, loan can be repaid in part or in full ahead of schedule. Part prepayments will be accepted subject to the condition that only THREE such part payments will be made in a financial year and that the amount prepaid each time will be equivalent to not less than 6 EMIs.

Home improvement loans are meant for new/existing customers who wish to renovate or remodel their homes.

You can avail a home improvement loan for a maximum term of 20 years or till your age of retirement, whichever is lower.

Home improvement loans can only be used to fund the purchase of immovable furniture and fixtures.

Home extension loans are open to anyone who wishes to add more space to their residence-be it apartment or individual tenement. Customers who have already availed home loans from Sundaram Home, are also eligible.

Home extension loan can be availed for a maximum term of 20 years or until the age of retirement-whichever is lower.

The loan will be disbursed once relevant documents required to establish clear and marketable title are submitted, sufficient progress in construction proportionate to the own contribution is evident, loan agreements executed and conditions, if any, complied with.

The loan will be disbursed in full or in suitable installments taking into account the requirement of funds and progress of construction as assessed by us.

You can apply for a top up loan after 12 months' of the final disbursement of your existing home loan and upon possession / completion of the existing financed property.

You can avail a top up loan for a maximum term of 15 years or till your age of retirement, whichever is lower.

Yes, you can avail an additional top up loan along with take over Loan.

Borrowers can avail a takeover loan to transfer their outstanding home loans from other banks to Sundaram Home. Thus we essentially takeover your loans from other banks.

Borrowers who have existing home loan arrangement from other banks and have been paying regularly for 12 months or more, could avail take over loan facility from Sundaram Home.

Yes, they can.

Yes, additional top up loan can be availed along with take over loan.

Sundaram Finance offers you the opportunity to meet your personal financing needs for marriage, medical expenses or education or business needs of expansion, to debt refinancing to pay off existing loans, with its loan against property facility.

As an existing customer, you may avail a maximum funding not exceeding 60% of the market value of the mortgage property. The funding is capped off at 50% of the market value for new customers. Market value in both cases shall be assessed by Sundaram Home.

Loan against property can be availed for a maximum term of 15 years or until the age of superannuation of the availer, whichever is lower.